Tan, with Y Combinator, which helped launch startups including Airbnb, Reddit and Instacart, said the biggest threat right now is not to the Rokus of the world, but rather to the scrappy startups that were already fighting to stay alive amid a challenging fundraising environment. "At this time, the company does not know to what extent the company will be able to recover its cash on deposit at SVB," officials at Roku wrote of what amounts to about 26% of the company's cash.

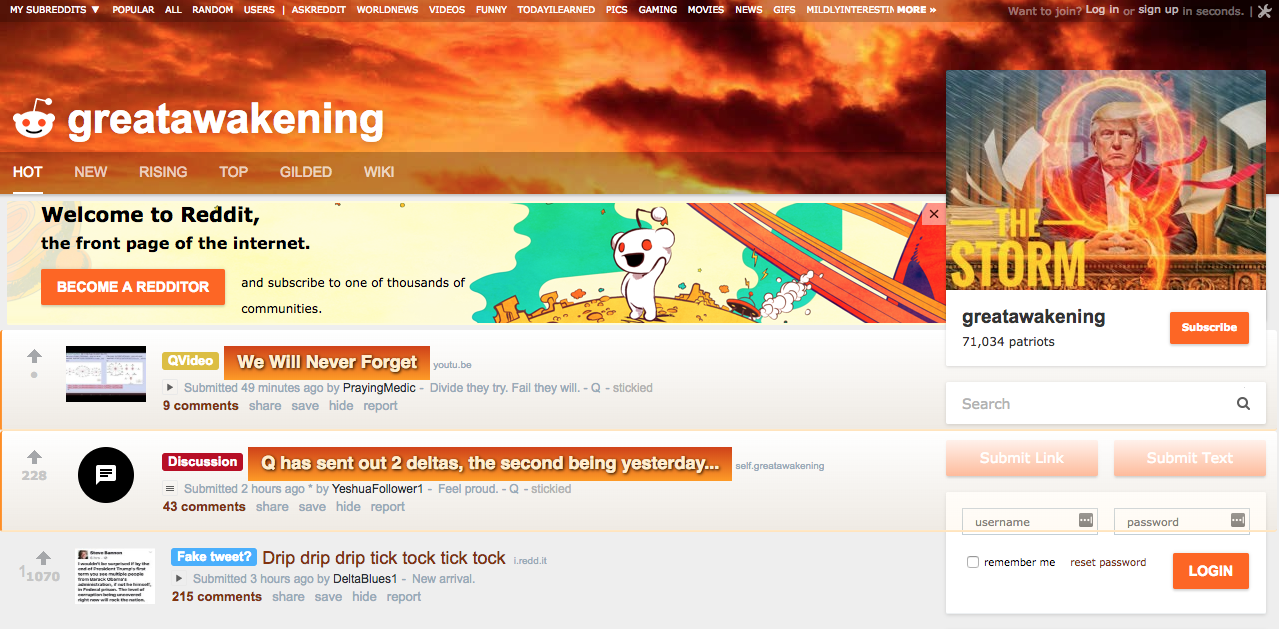

#QANON MELTDOWN REDDIT TV#

Roku, the TV streaming provider, was among the companies caught in the middle to the tune of $487 million, it said in a regulator filing on Friday. Silicon Valley Bank did business with well-known tech companies including Shopify, Pinterest, Fitbit and thousands of lesser-known startups, in addition to established venture capital firms, like Andreessen Horowitz. "It's these services that startups couldn't get elsewhere." "If you're a high-growth startup, you can't get a credit card from a normal credit card provider, you can't get a loan from a big bank, but Silicon Valley Bank would give you that," Shelf Engine's Kalb said.

While critics consider the idea of the government rescuing the bank a bailout for the tech and venture capital world, Tan argues that such a move would save depositors, many of which are small businesses in the tech sector. "If the government doesn't step in, I think a whole generation of startups will be wiped off the planet," Garry Tan, president and CEO of the startup incubator Y Combinator, said in an interview. It is a nail-biting limbo state that many tech startups deeply entrenched in Silicon Valley Bank are now facing in the wake of the bank's implosion, the largest American bank failure since the 2008 financial crisis.įor tech startups, which for decades have relied heavily on the bank based in Santa Clara, Calif., it has set off a crisis that could lead to mass layoffs, or hundreds of startups collapsing, according to industry insiders. "It was a very large sum of money," he said of the transfer. While he declined to provide the exact amount, he noted that Shelf Engine has raised more than $60 million from investors. "We woke up this morning hoping the money would be in that JPMorgan bank account, and it was not." "Unfortunately, our wire was not honored and our money is still at Silicon Valley Bank," Kalb, 37, said in an interview on Friday. He and his team quickly opened an account at JPMorgan Chase and attempted to wire transfer every last penny out of Silicon Valley Bank.

0 kommentar(er)

0 kommentar(er)